S&P 500 Jumps 26% in 86 Calendar Days: What's Next? | Wayne Whaley

Historical data shows similar rallies led to gains of 19.2%+ over the next year...

The S&P finished the 4th of July week at 6,279.35 and is now up 6.76% for 2025 and 13.4% over the last 12 rolling months (July4-July4), currently residing at an All Time High for at least the three day weekend.

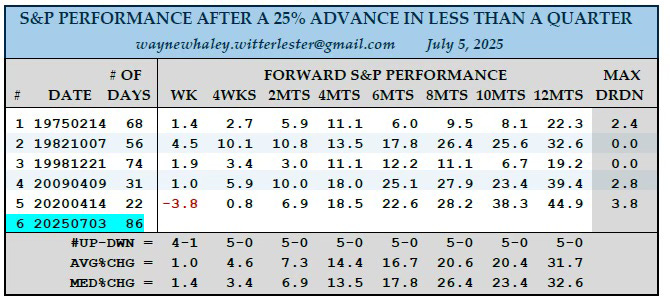

You may recall that the S&P experienced an 18.9% selloff from the February 19th Close of 6,144.15 to the April 8th Close of 4,982.77, exceeding 20% if measured vs the April 8th intraday Low of 4,910.42. From that 4,982.77 Closing Low on April 8th, the S&P has now advanced 26.0%, doing so in less than a Quarter, 86 calendar days (April 8 - July 3) to be precise.

Looking back through post 1950 history, I can only find five prior occasions in which the S&P has advanced 25% in less than a Quarter and none of those five occasions were anywhere near an impending top.

Certainly, one would prefer to have more than five data points from which to draw conclusions upon which to base one's market exposure but the magnitude and uniformity of the advances across the following 12 months in those five cases appears worthy of our respect. All five cases were positive over the following 1 to 12 months, up at least 19.2% one year later, 31.7% on average. None of the five cases experienced a 4% drawdown as measured from the signal Date.

Wayne Whaley July 5, 2025

See also:

Branimir Vojcic (July 5, 2025) - The NAAIM Index vs the S&P 500.

David Hickson (June 30, 2025) - Hurst Cycles Analysis Update for the S&P 500.

Jeff Hirsch (June 25, 2025) - July 2025 Post-Election Seasonal Pattern of US Stock Indices.

Posted by Time-Price-Research at Sunday, July 06, 2025

Email ThisBlogThis!Share to XShare to FacebookShare to Pinterest

Labels: Data Mining, Jay Kaeppel, S&P 500, Statistics, US Stocks, Wayne Whaley

Financial Markets & Universal Law is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.